Rebalance and stabilize property taxes

Pathways to Potential: 2021 MUNICIPAL ELECTION PLATFORM

Calgary should be a competitive and stable place to do business, supported by fair and equitable contributions from residents and businesses to support service delivery and community well-being.

Challenge

Non-residential (business) properties in Calgary have seen the largest tax hikes among major cities in Canada over the last several years. For example, under our current system, large industrial warehouses could have seen a 23.1 per cent increase in property taxes this year, prevented only by Council reactively capping that increase at 10 per cent.

Three key elements contribute to Calgary’s property tax challenge:

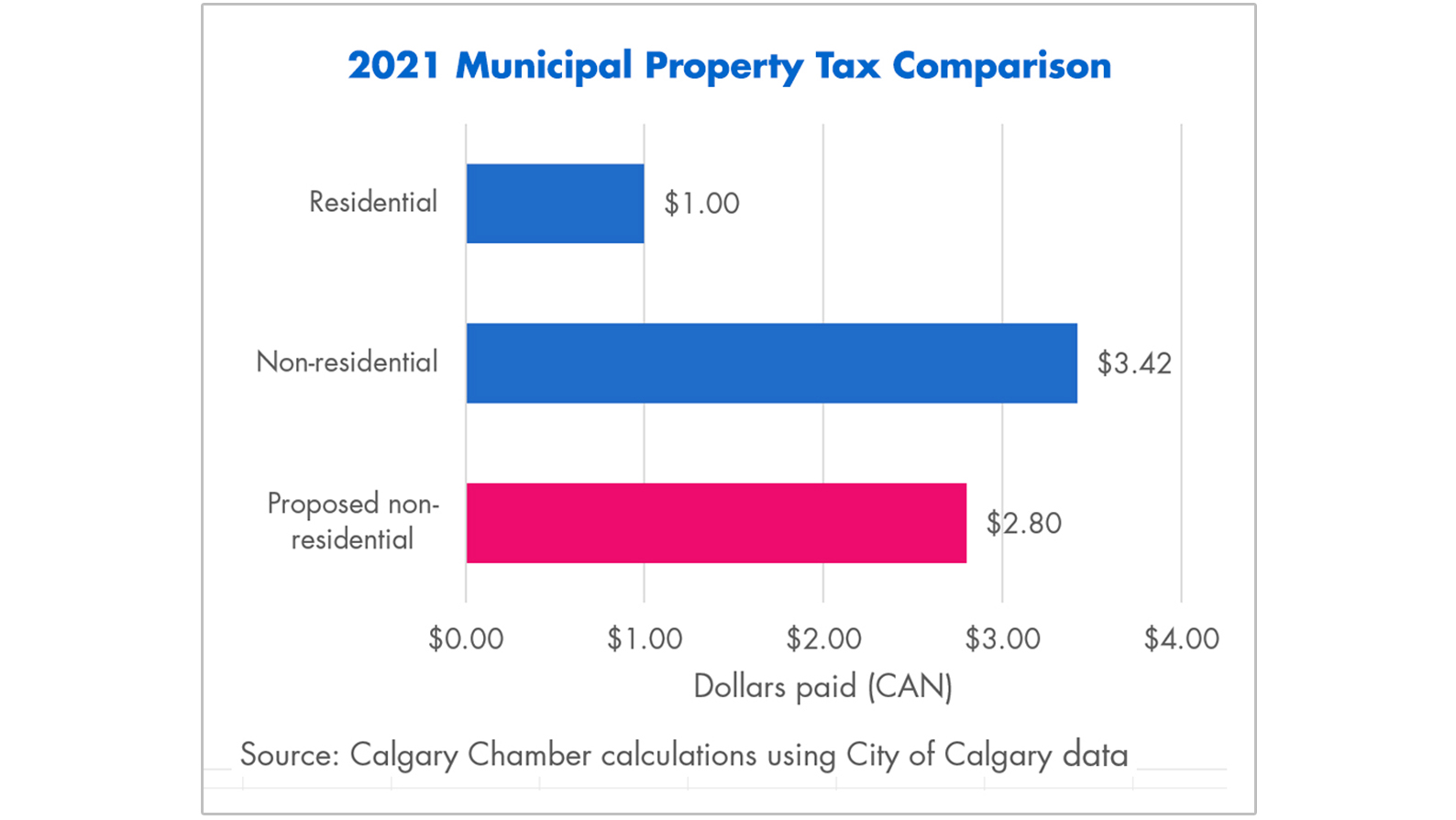

- Imbalanced residential and non-residential property tax: Calgary has one of the highest ratios of non-residential to residential property tax in Canada, across comparable jurisdictions. This means businesses in Calgary pay a significantly higher portion of municipal tax compared to residential properties in the city, even though residential properties far outnumber non-residential properties.

- High downtown vacancy rates: Calgary’s downtown core is almost one-third empty, resulting in a significant depreciation of assessment values for the downtown area. To compensate for the gap in the City’s operating budget, the tax burden has disproportionately shiftedto businesses outside the core.

- Short term solutions for long-term problems: In 2016, the City of Calgary introduced the Phased Tax Program (PTP), which was intended as a one-time fix to subsidize a portion of non-residential property tax. The PTP was subsequently used in 2017, 2018, 2019, and 2020, but does not address the need for long-term solutions to the City’s tax challenges.

Opportunity

Annual increases and associated uncertainty are directly threatening the survival and viability of Calgary businesses at a time when they most need support. Introducing long-term, structural changes to Calgary’s property tax system will bolster business resiliency during challenging economic periods, provide a higher level of certainty and stability for existing businesses, and encourage new investment.

Pathways to Potential

1. Introduce fairness between the non-residential and residential property tax rates.

Reducing the non-residential to residential property tax ratio will increase our competitiveness and encourage businesses to start and grow.

Reduce the non-residential to residential property tax ratio from 2.8 to 1 by 2022.

2. Accelerate and explore mechanisms for municipal revenue generation.

Alternative methods of revenue generation help alleviate the tax burden on property owners.

Consider establishing an arms-length entity to lease non-revenue generating surplus land as additional and recurring sources of revenue, and in some cases, opportunities for business. This should be in advance of the work of the Enhanced Rationalization Program examining opportunities for land sales.

Examine and propose legislative and regulatory changes, in collaboration with the Government of Alberta, that allows cities to introduce new revenue generation models and strategies.

Continue consulting with the Real Estate Working Group to gather business input into the City’s finances.

3. Increase transparency and accountability in the system.

Despite improvements, businesses continue to face challenges in understanding their property tax assessment and the changes they see.

Build on progress made in recent years to further enhance transparency and accountability, making information about taxation and revenue allocation more accessible.

Improve the property tax assessment dispute resolution process by taking a client-centric approach.

4. REDUCE COSTS AND INCREASE EFFECTIVENESS OF LOCAL GOVERNMENT.

Keeping costs low helps reduce the tax burden on both businesses and residents.

Further advance the critical work of the City’s SAVE program, to further increase cost savings and operational efficiencies.

Introduce longer-term efficiencies such as privatizing services, managing consulting costs and increasing operational efficiencies of City Administration.